does indiana have a inheritance tax

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states.

Indiana Estate Planning Elder Law Gift Tax

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

. Transferring Inheritance Money To The US. Indiana repealed the inheritance tax in 2013. In general estates or beneficiaries of.

No inheritance tax has to be paid for individuals dying after December 31 2012. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Twelve states and Washington DC.

The tax rate varies depending on the relationship of the heir to the decedent. The rates for Pennsylvania inheritance tax are as follows. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

There is no federal inheritance tax and only six states levy the tax. Any income from your inheritance will be taxed in the US according to US rules. Impose estate taxes and six impose inheritance taxes.

At this point there are only six states that impose state-level inheritance taxes. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. The tax rate is based on the relationship of the inheritor to the deceased person.

There is also an unlimited charitable deduction for inheritance tax purposes. Indiana does not have an inheritance tax nor does it have a gift tax. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death.

For those who do not plan the amount of Federal Estate Tax that will be required to be paid can approach 50 of the amount in the Estate over the 525 million. You only have to pay US inheritance tax if the deceased was a US resident citizen or green card holder. Indiana inheritance tax was eliminated as of January 1 2013.

How Much Is Inheritance Tax. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. 0 percent on transfers to a.

Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012. The Inheritance tax was repealed. Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states.

Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Indiana is one of 38 states in the nation that does not have an estate tax.

On the federal level there is no inheritance tax. The amount can be doubled for a married couple with properly drafted Wills or Trusts. Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary.

For individuals dying before January 1 2013. However youll still have to report your inheritance to the IRS by filing Form 3520 along with your annual tax return. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

However many states realize that citizens can avoid these taxes by simply moving to another state. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar.

There is no federal inheritance tax and only six states levy the tax. So the net effect was that high income and high asset people were moving to other states does lowering overall taxes. No tax has to be paid.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. States have typically thought of these taxes as a way to increase their revenues. As a result of this weve included information on how the Indiana estate will manage your estate if you have a legal will as well as information on who is entitled to your property if.

Indianas inheritance tax still applies. There is no inheritance tax in Indiana either. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Maryland is the only state to impose both. The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

Indiana repealed the inheritance tax in 2013. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

In Pennsylvania for instance there is an inheritance tax that applies to out-of-state inheritors. It doesnt matter how large the entire estate is. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent.

In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. If you have any questions concerning the repeal of the Indiana Inheritance Tax the administration.

Indiana Income Tax Calculator Smartasset

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

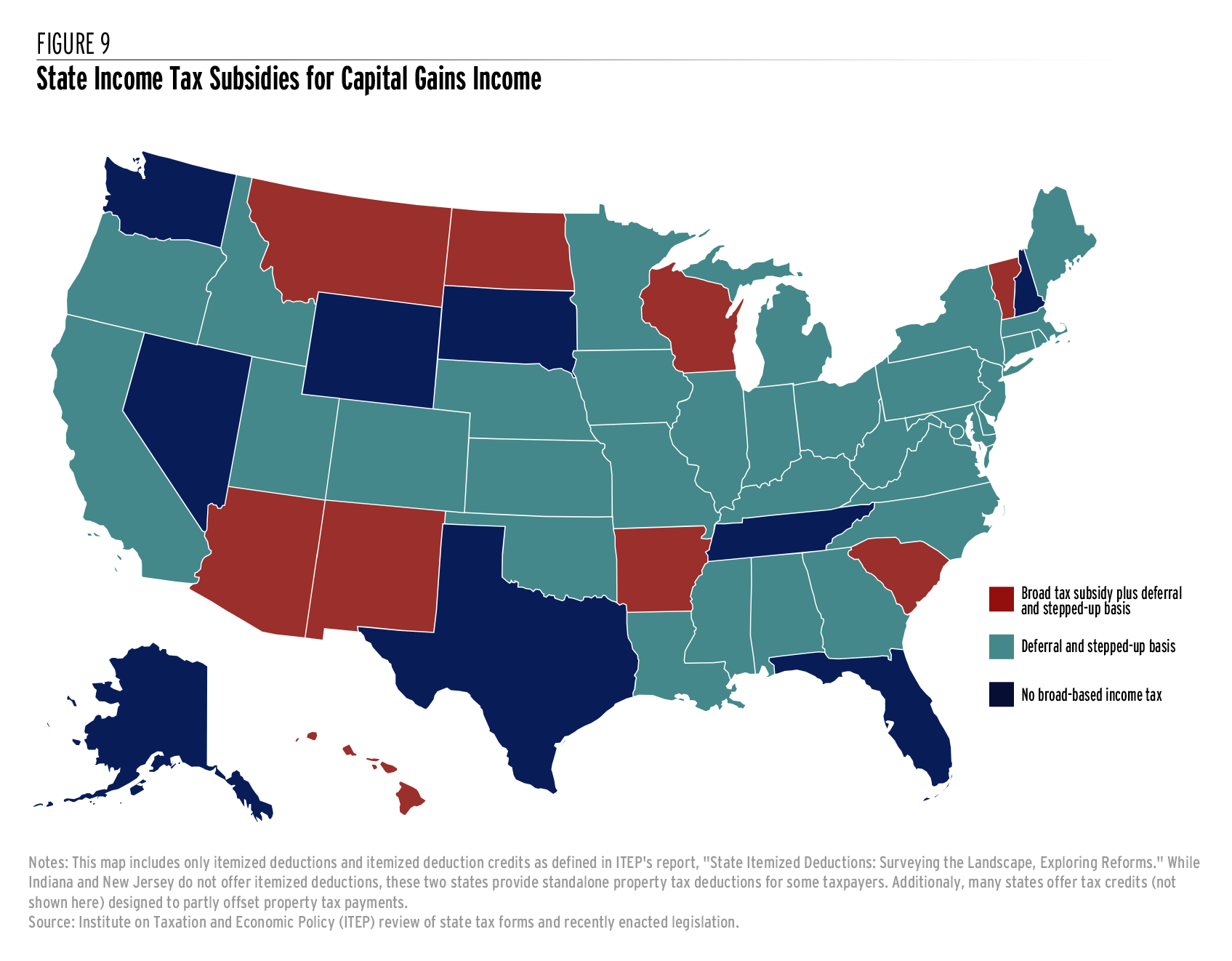

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Hello Goodbye Quincy S Calling But The Illinois Death Tax Says Goodbye Muddy River News

Is Your Inheritance Considered Taxable Income H R Block

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

Indiana County Assessors Association Serving Our Counties With Pride

Recent Changes To Iowa Estate Tax 2022

Indiana Last Will And Testament Legalzoom Com

Annuity Beneficiaries Inheriting An Annuity After Death

Indiana Last Will And Testament Legalzoom Com

We Buy Houses Indiana Asap Cash Home Buyers

How Do State Estate And Inheritance Taxes Work Tax Policy Center